Climate Change

Management

Challenges, Risks,

and Impacts

Thailand is committed to achieving the long-term goal of net zero greenhouse gas emissions by 2065. This pledge accelerates the efforts for both public and private sectors to manage greenhouse gas emissions more effectively through the draft of the National Climate Change Act, which will be effective soon. Additionally, the national clean energy production and utilization have been emphasized to respond to the forthcoming changes in consumption patterns and stakeholder expectations in the energy sector. Thaioil Group has recognized these challenges and reflected them as the Company’s risks and opportunities to determine the most effective target and long-term strategy.

Targets

GHG emission reductions

(Scope 1 and 2)

Target 2024

-

Percent compared with base year

Long-term Target

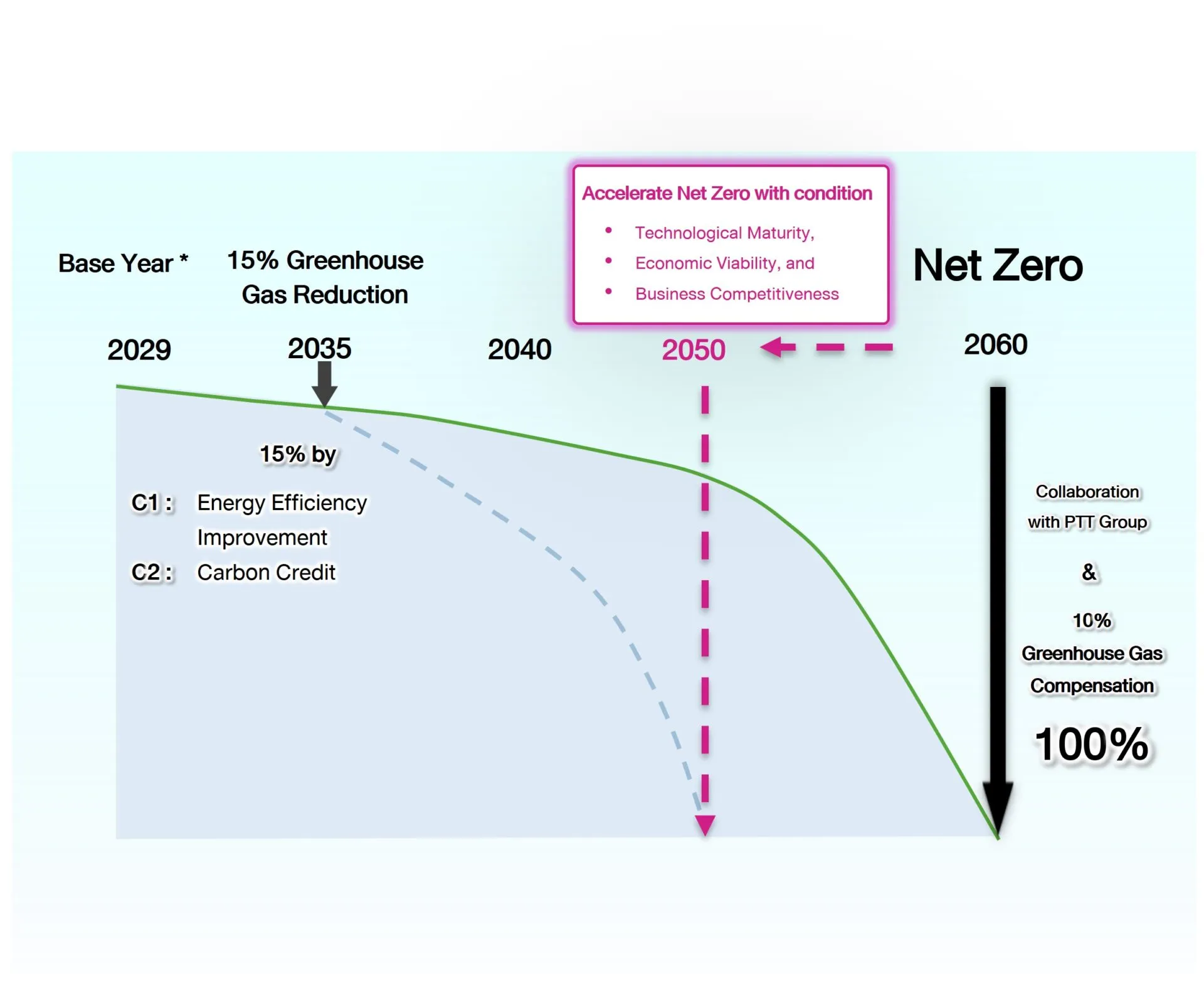

Reduce 15% of GHG emission by 2035

compared with the base year in 2026

GHG emissions

(Scope 1 and 2)

Target 2024

Less than 3,760,000

Ton of carbon dioxide equivalents (tCO2e)

Net Zero GHG Emissions

by 2060

Accelerate Net Zero Target

to 2050

with conditions of technological maturity, economic viability and business competitiveness

GHG emissions

(Scope 1)

Target 2024

Less than 3,670,000

Ton of carbon dioxide equivalents (tCO2e)

GHG emissions (Scope 2)

Target 2024

Less than 90,000

Ton of carbon dioxide equivalents (tCO2e)

GHG emissions (Scope 3)

Target 2024

Less than 50,000,000

Ton of carbon dioxide equivalents (tCO2e)

Thaioil Group's Net Zero GHG Emissions Targets

The company-wide target covers all relevant segments, accounted for 100% of companies under operational control or more than 95% of total sale revenue.

Remark : * The first year of full commercial operation of the CFP project

Management Approach

and Performance

Governance and Oversight

The Board is also tracking climate-related key performance indicators including Energy Intensity Index and Greenhouse Gas Intensity, which are the Corporate Key Performance Indicators, to evaluate the performance of management executives and employees.

In 2024 strategic review, the Board endorsed the Net Zero GHG Emissions Pathway and considered budget and investment approach in low carbon technology, such as studying the installation of Carbon Capture technology in production unit, studying Blue and Green Hydrogen business, and studying Sustainable Aviation Fuel (SAF) production.

The Board of Directors has assigned the Corporate Governance and Sustainability Committee (Board level) to oversight and monitor the performance of sustainability initiatives, including the management of topics related to climate change on a semi-annually basis. The Sustainable Development Steering Committee (Management level), chaired by the Chief Executive Officer and President, is also assigned to drive the implementation, and monitor the progress on a quarterly basis. The executives of Thaioil Group take responsibility for the management in line with the established strategy. “The Net Zero GHG Emissions Governance Structure” is established where the Vice President of the Sustainability Function is supervising overall management, including the integration of work processes with Corporate Strategy Function, Production Function, Business Development Function, Research and Development Function, and Corporate Social Responsibility Function. The functions have the roles of assessing climate-related risks and opportunities, conducting work in accordance with the organizational climate strategy, developing action plans that align with Thaioil Group’s Net Zero GHG Emissions Pathway and Roadmap, and reporting the performances as well as risks and opportunities management to the committees on a regular basis.

Thaioil Group’s climate governance can be summarized as the followings:

Level | Roles and Accountabilities | Meeting Frequency |

|---|---|---|

The Board of Directors | • Oversee the corporate climate change strategies, execution roadmap and performance. | As needed |

The Corporate Governance and Sustainability Committee – Board level | • Define and review sustainability strategy, plan, and goals, which include climate related issues. • Oversee the setting of climate-related targets. • Oversee and monitor the development and implementation progress of corporate climate change strategies, roadmap, and climate-related key performances. | Semi-annually |

The Sustainable Development Steering Committee – Executive level | • Drive the implementation, and monitor the progress of corporate climate change strategies, climate risks management and mitigating actions and the development of a climate transition plan. • Review and approve the annual sustainability material topics, including climate actions along with corporate sustainability strategies. • Review and endorse Thaioil Group’s Net Zero GHG Emissions Pathway, including the interim target to reduce GHG emissions by 15% by 2035 from the base year of 2029. This is consistent with Thaioil Group’s Net Zero GHG Emissions target by 2060. • Steer and support various internal functions to actively participate in integrating operations towards a sustainable organization across all ESG dimensions. This included approving key sustainable development plan to achieve Thaioil Group’s sustainability targets. | Quarterly |

The “Net Zero GHG Emissions Governance Structure” | • Assess climate-related risks and opportunities, including aligning their work as per the organizational climate strategy, developing action plans and Thaioil Group’s Net Zero GHG Emissions Pathway and Roadmap, and regularly reporting performances as well as risks and opportunities management to the management, executives and Board committees. | As needed

|

Thaioil Group has defined the Net Zero GHG Emissions Strategy, called the 3Cs strategies with the details as follows:

Climate-Related Risk and Opportunity Management

The Transition Scenario

Stated Policy Scenario (STEPS)

This scenario represents a pathway that considers the current policies and targets that governments have announced including the Nationally Determined Contributions under the Paris Agreement

Sustainable Development Scenario (SDS)

This scenario represents a “well below 2 °C” pathway achieved through transitioning into a low-carbon economy and meeting all current net zero pledges from EIA (International Energy Agency: (IEA))

Climate-related risks and opportunities by considering 4 factors

Regulatory Risk

Risk and Opportunity

Besides, carbon pricing can pose a risk in upstream operation. Particularly, in the case that the origin country of crude oil suppliers mandates the carbon price. This could result in an increase of the Company’s raw material costs. In downstream operations, likewise, the risks of carbon pricing can be posed by the execution of the EU’s Carbon Boarder Adjustment Mechanism (CBAM). This may impact the prices of some petrochemical products of the Company that is exported in the European market.

With these situations, the oil industry business might face challenges in adaptation. Also, the Company may encounter the risks on higher costs and long-term shift towards clean energy. However, the government initiatives present opportunities for the Thaioil Group to formulate its business strategy. For instance, if the government advocates or offers incentives for investing in clean energy ventures, such as hydrogen production or sustainable aviation fuel, it could facilitate Thaioil Group’s adaptation to change its business landscape.

Mitigation Measures

Closely monitoring the progress of regulatory enforcement.

Conducting Sensitivity Analysis for Carbon Pricing.

Joining membership of the greenhouse gas-related associations such as Thailand Carbon Neutral Network (TCNN) and Thailand Business Council for Sustainable Development (TBCSD) to monitor the regulatory enforcements and directions for the private sector.

Monitoring the impacts of carbon prices in case of transmission from crude oil suppliers and conducting appropriate sourcing strategies.

Technological Risk

Opportunity

Mitigation Measures

Conducting feasibility study for the use of carbon capture technology in the production process.

Participating in a feasibility study of applying carbon transportation and storage in the Eastern region with PTT Group.

Seeking business opportunities in carbon utilization for commercial use.

Seeking business opportunities in blue or green hydrogen business.

Seeking business opportunities in New S-curve Business

Market Risk

Opportunity

could cause an uncertainty in business revenue. Besides, the trends of energy transition occurring in many countries may impact future markets while the growing demands of electric vehicles may disrupt the needs for oil and other fossil fuels.

Moreover, the National Electric Vehicle Policy Committee (EV Board) has announced the 30@30 policy. The goal is to produce Zero Emission Vehicle (ZEV) – vehicles emitting zero emissions – at least 30 percent of the total vehicle production by 2030. In 2023, the EV board issued measures to support the use of electric vehicles in Phase 2 or EV 3.5 over a 4-year period (during 2024-2027). These measures are expected to accelerate the rapid behavioural change in consumer behaviour towards ZEVs.

With the growing demand for clean and renewable energy, Thaioil Group has recognized the impacts on its product sales in both the short- and long-terms. However, the energy transition also creates opportunities for the Company to explore new business investment and new products.

Mitigation Measures

Adjusting gasoline production ratio in alignment with the decreasing demands in the future. Increasing the production efficiency of investing in diesel and aviation fuel production through Clean Fuel Project (CFP).

Adjusting the structure of business portfolio to support the future market.

Analysing the peak oil demand and consistently tracking market trends to refine the product portfolio structure accordingly.

Investing in PT Chandra Asri Petrochemical Tbk (CAP), a leading petrochemical company in Indonesia, to adjust the structure of the product portfolio towards the high-demand chemical market.

Conducting the feasibility study of biofuel.

Joining the feasibility study of sustainable aviation fuel (SAF) with PTT Group.

Continuously engaging with customers to perceive their future product needs and adjusting the business strategies to focus on high-value products, specialty chemicals products, and commodity products.

Reputational Risk

Opportunity

The factors that may affect Thaioil Group deal with an insufficient action to mitigate climate-related impacts in response to the expectations of stakeholders such as societies, communities, employees, shareholders, and creditors.

Mitigation Measures

Declaring net zero GHG emissions commitment.

Developing a net zero GHG emissions pathway.

Constantly communicating on the progress.

Joining groups and organizations that promote sustainable development and national commitments.

Result of

Financial Impact Assessment (EBITDA)

Key Risks

- Impact of carbon pricing from carbon dioxide equivalent emissions in the Company’s production process. The scenario analysis has been conducted in the case that Thailand adopt the GHG Emission Trading Scheme (ETS). The capacity has been limited by the GHG emission of Thaioil Group 2022. The carbon price in 2030 and 2050 is referred to the IEA World Energy Outlook 2021.

- Impact of declining demands on the Company’s products from the shift to use alternative energy (Downstream). The demand for oil products in ASEAN is referred to the IEA World Energy Outlook 2021.

- Impact of carbon pricing from the increasing crude oil price by crude oil suppliers (Upstream). The scenario analysis has been conducted in the case that the suppliers have an impact from carbon taxes and consequently affect the Company’s cost at 100%.

The Physical Scenario

Thaioil Group has assessed physical risks of both acute and chronic impacts from rising global temperature. The scenario analysis has been conducted in the period of 2030, 2040, 2050 across supply chain, covering upstream, existing operating, new operation (including the Clean Fuel Project: CFP), and downstream. Representative Concentration Pathways (RCPs), a recognized climate model of the Intergovernmental Panel on Climate Change (IPCC), has been applied in two scenarios as below:

The RCP 2.6 scenario represents a stringent greenhouse gas reduction measure.

The RCP 8.5 scenario represents a rapid increase in greenhouse gas emissions.

Climate-related risks and opportunities by considering 2 factors

Water Scarcity

Risk

Mitigation Measures

To balance between business interests and stakeholders’ expectations, Thaioil Group has agreed with government agencies to give importance to the community as the first priority during water shortages. This is to ensure the surrounding communities have adequate water irrigation for agriculture and consumption for their daily needs before any allocation to Thaioil Group. Furthermore, Thaioil Group has established a “Long-term Water Supply Strategy 2023–2033” to ensure water security and reduce the risk of water scarcity that may impact both business operations and future expansion projects. Thaioil Group’s water management is summarized as follows:

At the present, Thaioil Group uses two types of water. The seawater is processed to freshwater through the Thermal Desalination unit. The raw water is sourced from two different water distributors namely the Bang Phra Reservoir, which is operated by the Royal Irrigation Department, and the Nong Kho Reservoir, which is operated by the Eastern Water Resources Development and Management Public Company Limited. Both water distributors operate integrated water systems alongside Thaioil Group through aligning practices with government policies or the local context of shared water use in the area. This is to ensure adequate water supply within Thaioil Group’s production processes, such as the cooling tower system, demineralization for steam production, and other production processes. The Company consistently improves and monitors water quality to exceed the required standards before discharging into the environment. To further minimize the impacts on the ecosystem, the circular economy and 3Rs (Reduce, Reuse, Recycle) principles are adopted in water management to maximize the utilization efficiency.

There are ongoing feasibility study projects under the “Long-term Water Supply Strategy 2023–2033” as follows:

1. A study project on installing additional desalination units from six existing units. This project aims to increase the proportion of water consumption from seawater, which is considered an unlimited natural resource, to replace freshwater consumption, which is considered a limited natural resource.

2. A study project on the recycled wastewater from the water treatment plant.

3. A study project on reverse osmosis system for recycling wastewater.

4. A study project on Pattaya wastewater recycle to reuse wastewater in the urban communities.

Moreover, under construction project is as follows:

A raw water utilization project from the private pond

Other Physical

Risks

Mitigation Measures

Predicting and monitoring cyclone events and relevant warning system.

Preparing the production and delivery of products plan in advance before offshore cyclone occurs.

Reviewing and developing emergency measures to prevent cyclone-related harm.

Result of

Financial Impact Assessment (EBITDA)

Key Risk

- Impact of water shortage: In case that the government sector reduces water supply to the Company by 10%, the Company must align its investments with the Long-term Water Supply Strategy. The Company is required to consider increasing the volume of freshwater from private sources and freshwater production from seawater by the Thermal Desalination Unit. Additionally, the Company needs to prepare the water reservation plan in appropriate areas to provide adequate water in the production process. However, these measures could increase production cost.

- Impact of offshore cyclone events: The Company’s revenue could decline from the cyclone event, particularly in the case that the Company is unable to deliver the products through sea freight during the offshore cyclone event. Also, pre and post-cyclone events could disrupt the production process. In the pre-cyclone event, the Company must ensure worker safety and prevent damage to machinery and equipment. In the post-cyclone event, workplace inspections need to be conducted before operating the business as usual.

Internal Carbon Pricing

Thaioil has adopted Internal Carbon Pricing (ICP), a method that assigns a monetary value to greenhouse gas emissions, covering Scope 1 and 2 emissions. This pricing mechanism is used to evaluate projects that reduce and emit emissions within Thaioil Group and its subsidiaries.

This ICP approach is integrated to all business that falls under the scope of Thaioil Investment Management (TIM) procedures and changes to plants under the scope of Plant Change Procedure as part of the Company’s investment decision-making processes (Existing and Expansion assets with a shareholding proportion of more than 50% in new projects, such as mergers in businesses with production processes). Shadow carbon pricing is applied, with the Sustainable Development Steering Committee assigning a carbon value of $ 20 USD tCO2e/ tCO2, in alignment with PTT Group’s standards.

This internal carbon pricing approach has two main purposes: (1) To drive low-carbon investment and energy efficiency project through plant change to support the transition to a low-carbon future by identifying and seizing low-carbon opportunities, in which enabling Thaioil to assess the economic feasibility in terms of cost-benefit analysis of the projects within a carbon pricing framework, and make more informed strategic decisions that support long-term, sustainable reductions in greenhouse gas emissions. And (2) To Influence strategy and financial planning, in which carbon pricing is applied within the climate risk scenario analysis to identify and manage climate-related risks and opportunities, support strategic and financial planning by navigating changing regulations that may have financial impacts to Thaioil, such as Carbon pricing mechanism (Emission Trading Scheme (ETS) and Carbon Tax) under the Draft of National Climate Change Act or Global Warming Act.

2024

Performances

Reduction of Direct Greenhouse Gas Emissions (Scope 1)

(Scope 1)

Solar Rooftop at Thaioil’s Buildings Project

Thaioil Group has participated in the Thailand Voluntary Emission Reduction Program (T-VER), organized by the Thailand Greenhouse Gas Management Organization (Public Organization) under the project “Solar Rooftop at Thaioil’s Buildings.”

239-MW Combined Cycle Co-Generation Power Plant Project

Thaioil Group has participated in the Thailand Voluntary Emission Reduction Program (T-VER) organized by the Thailand Greenhouse Gas Management Organization (Public Organization) under the project “239-MW

Energy Efficiency Improvement Projects

The Low Emission Supporting Scheme (LESS) project, implemented through energy conservation activities aimed at improving energy efficiency within the Thai Oil Group

With the GHG management described above, Thaioil Group has controlled methane emissions at the set target. A significant portion of methane emissions originates from the same source as the other greenhouse gases.

The Thai Oil Group has set long-term, medium-term, and annual targets. The annual targets are evaluated based on the energy consumption of the business plan for each year. Through the implementation of energy efficiency improvement projects in the production process in 2024, the Thai Oil Group is expected to achieve its greenhouse gas emissions target for Scope 1, as outlined, as follows:

Reduction of Indirect Greenhouse Gas Emissions (Scope 2)

Thaioil Group has indirect greenhouse gas emissions (Scope 2) from the purchased electricity with the total of 30,753 ton carbon dioxide equivalents (tCO2e) or 0.88% of greenhouse gas emissions (Scope 1 and 2), which meets the target for greenhouse gas emissions under Scope 2, set at no more than 90,000 tons of CO2 equivalent.

Since 2023, we expanded our reporting boundary to include indirect greenhouse gas emissions (Scope 2). As Sriracha operations is accounted significant with emissions utilities, and office in Sriracha, enhanced by our increased use of renewable energy, including electricity purchased from TSB and EBC’s solar rooftop.

Reduction of Indirect Greenhouse Gas Emissions (Scope 3)

Indirect GHG management (Scope 3) from Thaioil Group’s supply chain is summarized as follows:

Studied and created opportunities to increase the value of waste disposed to landfill. The 3Rs method were adopted to control and reduce GHG emissions. In 2024, Thaioil Group successfully maintained zero waste to landfill performance against the set target.

Conducted risks assessment and developed plans to minimize ocean loss during the transportation. The product loading system through pipeline was also designed by the Energy and Loss Committee to reduce GHG emissions from the production and transportation system both land and sea.

Promoted the procurement of environmentally friendly products and services from partners. Moreover, the Company organized “Thaioil CE WE GO (Thaioil Circular Economy) project” to increase waste value through upcycling initiatives, such as upcycling plastic waste into QSHE shirts for employees and contractors, upcycling food waste into fertilizer, and others.

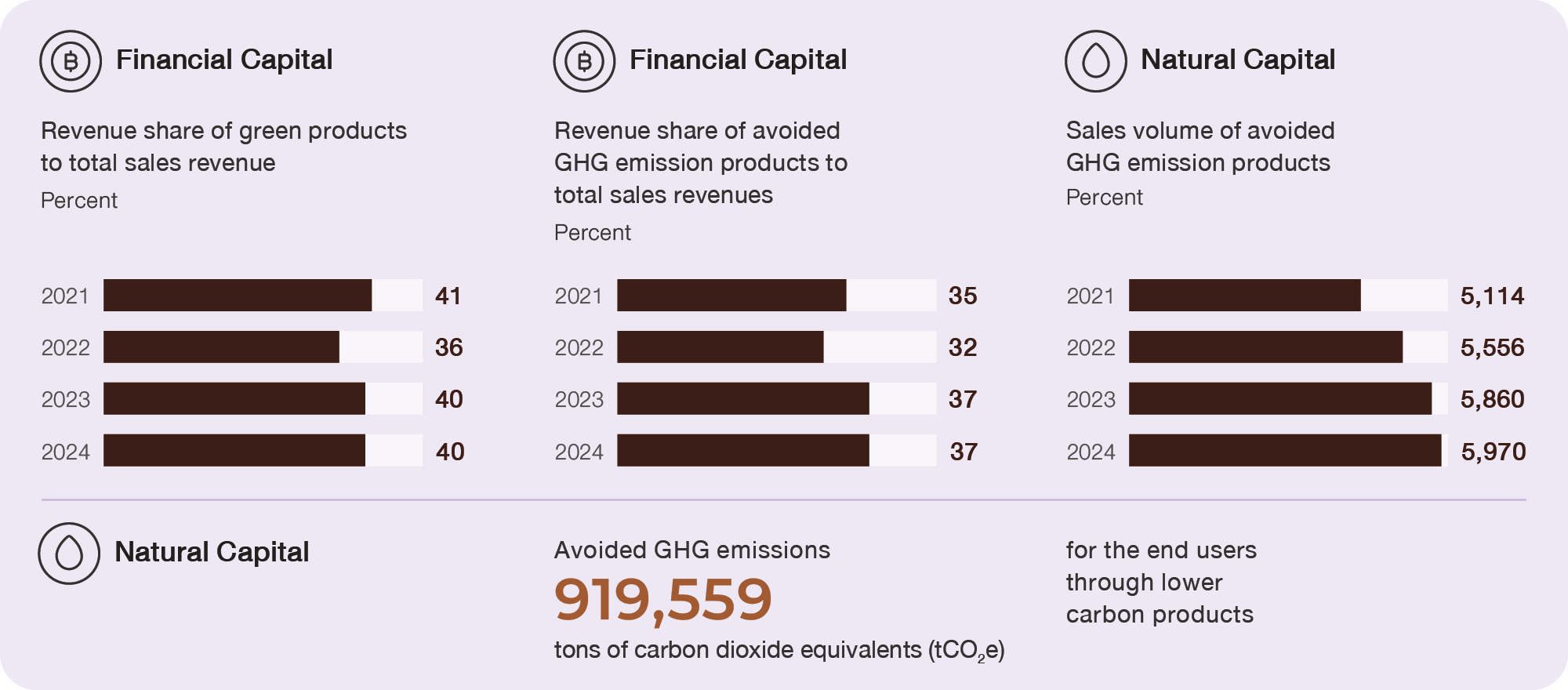

Sold the low-carbon products to reduce downstream GHG emissions of users from gasohol, biodiesel, and bioethanol.

Green Product Category | Product Sold by Thaioil Group | Company | Sales Value (Million THB) | Sales Volume |

|---|---|---|---|---|

Bio-based product

| Ethanol from cassava

| Thaioil Ethanol Company Limited (TET) | 1,715.70 | 56.40 million litres

|

Ethanol 99.5% (from cassava and corn)

| TOPNEXT International Company Limited (TX) | 1.79 | 41.69 tons

| |

Biodegradable Product

| Linear Alkyl Benzene (LAB) | LABIX Company Limited (LABIX) | 7,633.46 | 150,437.71 tons |

Heavy Alkyl Benzene (HAB) | 76.59 | 2,197.27 tons

| ||

Compostable Product | Cleaning products (KEEEN)

| TOPNEXT International Company Limited (TX) | 0.61 | 3.50 tons

|

Products that reduce emissions released to the environment (Emission Reduction)

| Benzene-free solvents, including:

| TOPNEXT International Company Limited (TX) | ||

– TOPSol BF: Benzene Free | 51.60 | 1,038.58 tons | ||

– Xylene (Isomer): Low Ethylbenzene | 1,108.31 | 32,737.58 tons | ||

– Methyl Cyclohexane (MCH) | TOP Solvent (Vietnam) Limited liability Company (TSV) | 2.88 | 53.32 tons | |

Solvents with low concentration of polycyclic aromatic hydrocarbons (TOPSol A 150 ND: Low PAHs)

| TOPNEXT International Company Limited (TX) | 44.69 | 678.14 tons

| |

Rubber oils (TDAE, TRAE, AROS) with PCA content below the international limit-thus non-carcinogenic and does not cause genetic mutation in humans.

| Thai Lube Base Public Company Limited (TLB) | 2,922.23 | 89,675.00 tons

| |

Low Sulfur Fuel Oil (LSFO or Fuel Oil IMO) with sulfur content at 0.5% or below

| Thai Oil Public Company Limited (TOP) | 2,885.66 | 152.83 million litres

| |

Products with lower GHG emissions than products of the same group in the market (Avoided GHG Emission Product)

| Cyclopentane CP80 and CP97, which are agents that can replace use of CFCs and HCFCs | TOPNEXT International Company Limited (TX) | 14.92 | 194.90 ตัน |

Gasohol

| Thai Oil Public Company Limited (TOP) | 45,209.92 | 1,434.66 million litres

| |

Biodiesel

| 122,554.67 | 4,535.29 million litres

|

Carbon Capture Utilization and Storage (CCUS) performance and progress

In 2022, Thaioil Group initiated a preliminary study to identify production units with the potential to implement CCS technology. This study included estimating the investment budget required for installing carbon dioxide (CO2) capture systems, as well as the associated transportation and storage infrastructure, to meet greenhouse gas reduction targets within specified timeframes. Furthermore, since 2022, Thaioil Group has maintained ongoing collaboration with companies in the PTT Group to conduct a feasibility study on CCS technology. This study benchmarks perspectives at both regional and international levels, covering not only the assessment of technology readiness but also evaluations of financial impacts, regulatory support from regional and international frameworks, as well as environmental impacts related to CCUS.

These conceptual studies assess the current and future demand for CCUS services across various sectors.

In 2023, The results of the study were compiled into a comprehensive report on the Eastern Thailand CCS Hub to inform relevant government agencies about policy frameworks and regulatory mechanisms that drive the implementation of CCS in Thailand.

In 2024, the Company, in collaboration with the PTT Group, engaged in discussions with various government agencies and organizations, including the Federation of Thai Industries, the Department of Industrial Works, the Pollution Control Department, and the Marine Department. These discussions aimed to align with Thailand’s climate change goals by promoting relevant policies, legislation, and support frameworks. Additionally, they focused on exploring investment opportunities, securing funding, and analyzing market demand.

Based on a preliminary feasibility study analysis on CCS technology investments, referencing the Longship and Northern Lights projects in Norway, it was found that the capital expenditure (CAPEX) and operational expenditure (OPEX) for CCS technology across the entire supply chain (Levelized Cost) requires significant capital investment1. To enhance the feasibility of CCS project implementation, the Company plans to further investigate and evaluate cost-effective and efficient carbon capture technologies to reduce future costs. Additionally, the Company is focusing on developing CCS business models in collaboration with the PTT Group and other strategic partners, while also exploring and securing funding sources to ensure projects can be delivered within specified timelines and budget constraints. Future studies will focus on CCS technologies. Examples of currently viable capture technology using amine-based solvents absorption and onshore and offshore carbon transport pipelines. These efforts aim to equip the Company with critical insights to enable informed decision-making and strengthen confidence in the successful execution of CCS projects.

Remarks:

1. Referencing the Longship and Northern Lights projects in Norway, it was found that the capital expenditure (CAPEX) and operational expenditure (OPEX) of the CCS project throughout the supply chain (Levelized Cost) are estimated to be more than USD 200 per ton of carbon dioxide equivalent (USD/tCO₂e)

(https://bellona.org/publication/briefing-norways-longship-ccs-project)